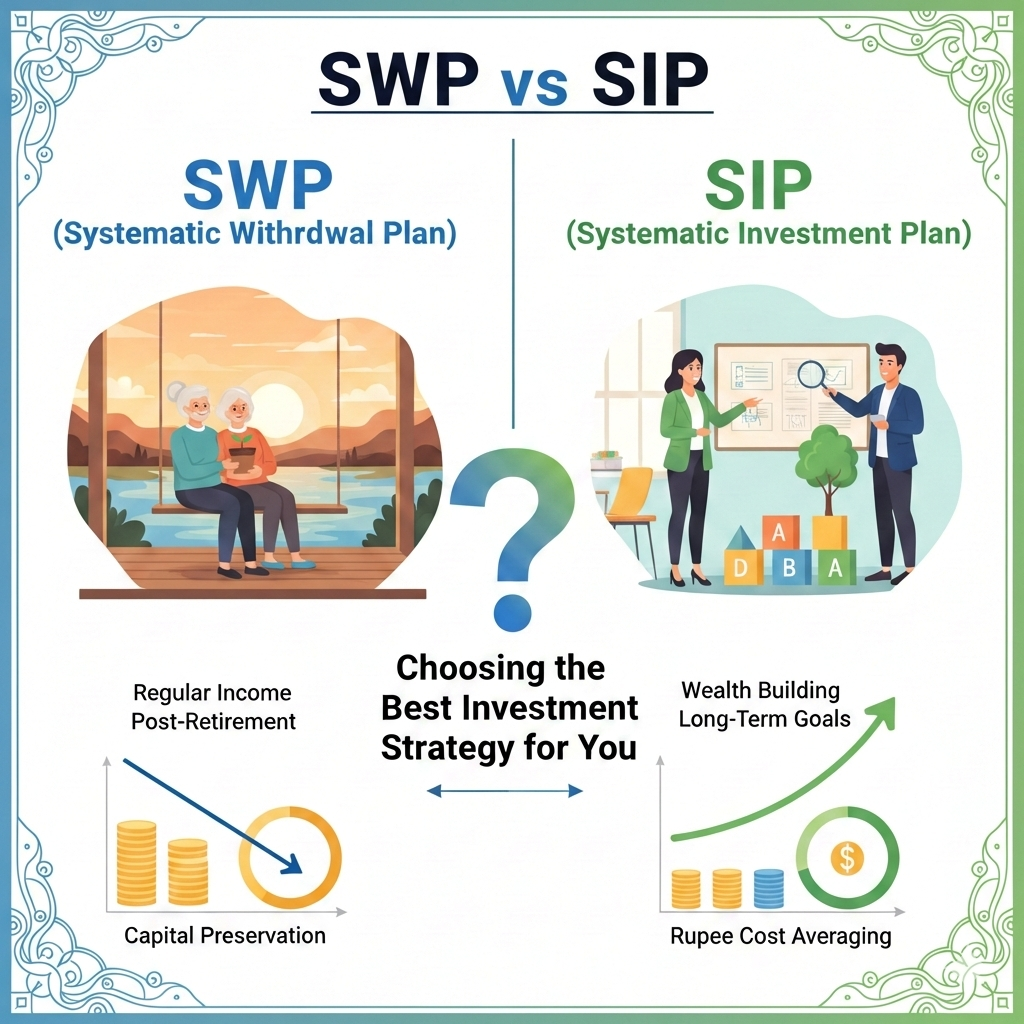

In the evolving landscape of personal finance, choosing the right investment strategy is crucial for achieving financial goals. Two popular methods, Systematic Withdrawal Plan (SWP) and Systematic Investment Plan (SIP), cater to different investor needs and objectives. Understanding the nuances of these strategies, especially in the context of current global trends, can help investors make informed decisions. This blog explores the intricacies of SWP and SIP, while also considering strategic insights from advancements in technology, sustainability, healthcare, cybersecurity, and remote work.

Understanding SWP and SIP

What is a Systematic Withdrawal Plan (SWP)?

A Systematic Withdrawal Plan (SWP) allows investors to withdraw a fixed amount of money at regular intervals from their investments, typically from mutual funds. SWPs are particularly beneficial for retirees or those seeking a regular income stream from their investments. By systematically withdrawing funds, investors can manage their cash flow while maintaining the bulk of their investment portfolio.

What is a Systematic Investment Plan (SIP)?

A Systematic Investment Plan (SIP) is an investment strategy where individuals invest a fixed amount of money at regular intervals into a mutual fund. SIPs are ideal for those who wish to build wealth over time by taking advantage of market volatility and the power of compounding. This approach encourages disciplined investing and can be particularly effective for long-term financial goals.

Advancements in Artificial Intelligence and Machine Learning

The integration of AI and machine learning into financial services is transforming how investment strategies like SWP and SIP are executed and optimized. AI can enhance decision-making by analyzing vast amounts of data to provide personalized investment recommendations based on an individual’s financial profile and market conditions.

Implications for SWP and SIP

- Efficiency and Automation: AI-driven tools can automate the monitoring and execution of SWP and SIP transactions, reducing human error and increasing efficiency.

- Enhanced Data Analysis: By leveraging machine learning algorithms, investors can gain deeper insights into market trends and optimize their SWP or SIP strategies accordingly.

- Personalized Strategies: AI can tailor investment strategies to align with individual risk tolerance, financial goals, and market conditions, making SWP and SIP more effective and personalized.

Sustainability and Green Technology

As global awareness of environmental issues grows, sustainability and green technology are becoming central to investment strategies. Investors are increasingly considering environmental, social, and governance (ESG) criteria in their decision-making processes.

Implications for SWP and SIP

- Investment Choices: Both SWP and SIP investors might opt for funds that prioritize sustainable and environmentally friendly companies, aligning their investments with personal values.

- Long-Term Growth: Green technology sectors can offer substantial long-term growth potential, making them attractive options for SIP investors focused on future wealth accumulation.

- Risk Management: Incorporating sustainability into investment strategies can help mitigate risks associated with environmental regulations and societal shifts towards eco-friendly practices.

Healthcare Innovation and Personalized Medicine

The rise of healthcare innovation and personalized medicine presents new opportunities for investors, particularly in the biotechnology and healthcare sectors. These advancements promise improved patient outcomes and reduced costs, driving growth in these industries.

Implications for SWP and SIP

- Sector Opportunities: SIP investors might look to incorporate healthcare and biotech funds into their portfolios to capitalize on growth in these sectors.

- Risk Diversification: SWP investors can diversify their income sources by investing in healthcare funds, which are often less correlated with traditional market movements.

- Long-Term Returns: The potential for breakthrough innovations in personalized medicine can lead to significant long-term returns, appealing to both SWP and SIP investors.

Cybersecurity and Data Privacy

With increasing digitization, cybersecurity and data privacy have become paramount. For investors, protecting financial data and ensuring secure transactions are critical components of any investment strategy.

Implications for SWP and SIP

- Secure Transactions: Both SWP and SIP rely on digital platforms for transactions, making robust cybersecurity measures essential to protect investor information.

- Trust and Compliance: Ensuring compliance with data privacy regulations enhances investor trust and can impact the reputation of financial service providers offering SWP and SIP options.

- Investment in Cybersecurity: Investors may choose to allocate part of their SIP to funds that invest in cybersecurity firms, recognizing the growing importance of data protection.

Remote Work and Digital Transformation

The shift towards remote work and digital transformation is reshaping industries and creating new investment opportunities. This trend necessitates new management strategies and drives the adoption of digital tools, influencing investment decisions.

Implications for SWP and SIP

- Adoption of Digital Platforms: Both SWP and SIP can benefit from digital platforms that facilitate seamless management and execution of investment strategies.

- Investment Opportunities: SIP investors might explore funds that focus on technology companies enabling remote work solutions, benefiting from the digital transformation trend.

- Flexibility and Accessibility: The digitalization of investment services provides greater flexibility and accessibility for investors, allowing them to manage SWP and SIP from anywhere.

Conclusion

Choosing between SWP and SIP depends on individual financial goals, risk tolerance, and investment horizon. SWP is ideal for those seeking regular income, while SIP is suited for long-term wealth creation. By understanding the impact of current global trends—such as advancements in AI, sustainability, healthcare innovations, cybersecurity, and digital transformation—investors can make more informed decisions and align their investment strategies with broader market shifts.

Disclaimer: This post is for educational purposes only and does not constitute financial advice. Read our full disclaimer here.