Introduction

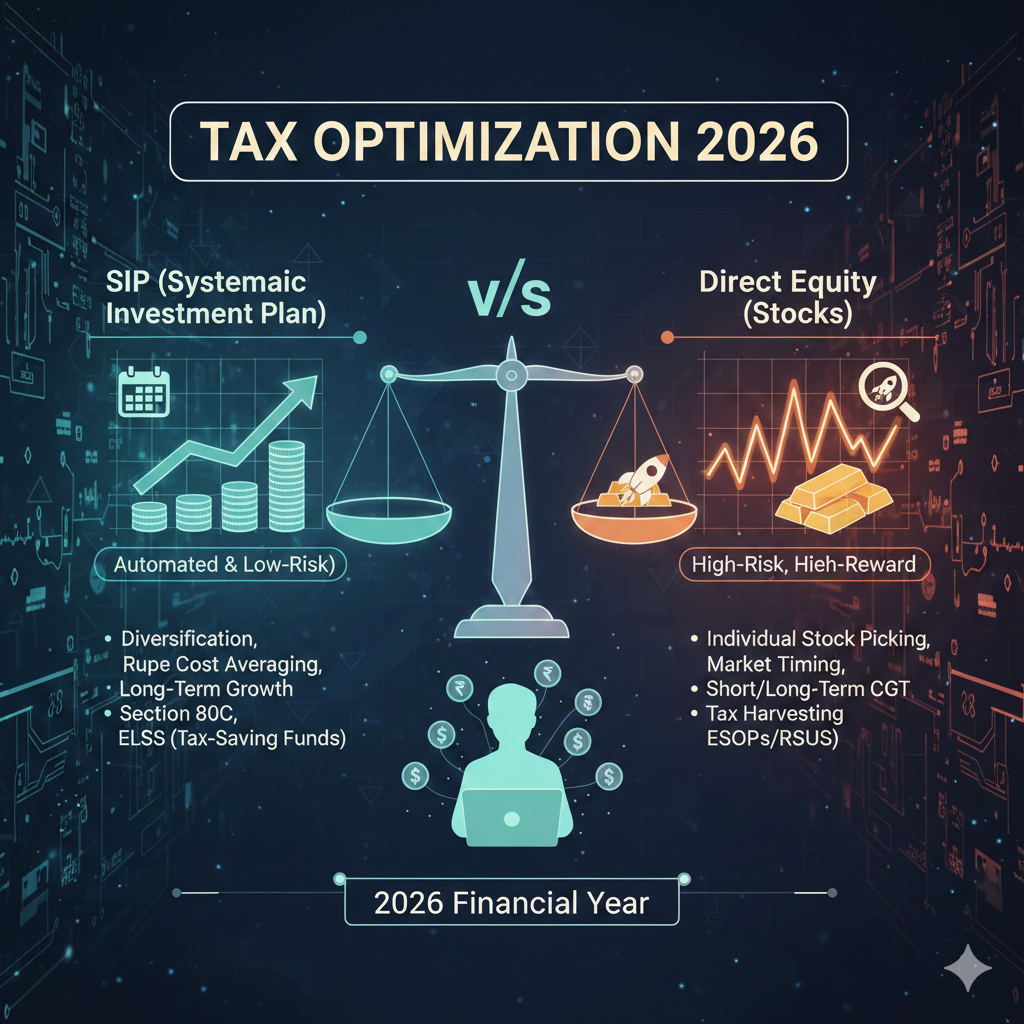

As tech professionals navigate the complexities of personal finance, the choice between Systematic Investment Plans (SIPs) and direct equity investment becomes pivotal, especially when it comes to tax optimization. With the rapid advancements in technology and changing economic landscapes, understanding the nuances of these investment avenues is crucial. This article delves into the tax optimization strategies for SIPs and direct equity, focusing on the trends shaping the future for tech professionals in 2026.

Advancements in Artificial Intelligence and Machine Learning

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into the financial sector is transforming investment strategies. AI-driven analytics are enhancing decision-making processes, offering tech professionals tools to optimize their portfolios effectively.

Implications for SIPs and Direct Equity

- Automated Investment Strategies: AI-powered platforms can analyze vast amounts of data to provide personalized investment recommendations, helping tech professionals decide between SIPs and direct equity based on historical performance and future forecasts.

- Enhanced Data Analysis: Machine learning algorithms can predict market trends, potentially offering insights into the best times to buy or sell equities, or adjust SIP allocations, thus optimizing tax implications.

- Cost Reduction: Automation reduces the need for expensive financial advisors, allowing tech professionals to manage their investments more cost-effectively, potentially enhancing after-tax returns.

Sustainability and Green Technologies

As the world shifts towards sustainability, green technologies are becoming a focal point for investors. This trend is shaping the landscape of investment opportunities, with significant tax incentives available for investments in eco-friendly sectors.

Implications for SIPs and Direct Equity

- Tax Incentives: Governments are offering tax benefits for investments in green technologies, which can be accessed through specific mutual funds in SIPs or direct equity in green companies.

- Long-term Growth: Investing in sustainable technologies aligns with long-term growth strategies, potentially providing better returns and favorable tax outcomes as these sectors expand.

- Market Opportunities: The rise of eco-friendly products opens new investment avenues. By investing in companies leading this change, tech professionals can benefit from both capital appreciation and tax savings.

Healthcare Innovations and Biotechnology

The healthcare sector is experiencing a boom, driven by innovations in biotechnology and personalized medicine. This sector’s growth presents unique investment opportunities, with implications for tax optimization.

Implications for SIPs and Direct Equity

- Sector-Specific Funds: SIP options focusing on biotech and healthcare can provide diversified exposure with potential tax benefits. These funds typically offer long-term capital gains tax advantages.

- Direct Investments: Investing directly in biotech companies can be lucrative but requires thorough research. The right picks can lead to significant gains, albeit with higher risk and potential tax implications on short-term gains.

- Ethical Considerations: Investments in healthcare innovations must consider ethical implications, impacting both the choice of investments and the associated tax strategies.

Cybersecurity and Data Privacy

With the increasing importance of cybersecurity, investing in this sector has become crucial. As regulatory frameworks evolve, understanding the tax implications of such investments is essential.

Implications for SIPs and Direct Equity

- Regulatory Changes: Anticipated changes in cybersecurity regulations may offer tax incentives for investing in compliant companies, whether through SIPs or direct equity.

- Risk Mitigation: Investing in cybersecurity firms can serve as a hedge against market volatility, potentially stabilizing portfolios and optimizing tax outcomes.

- Consumer Trust: Companies prioritizing data privacy may offer more stable investment opportunities, aligning with ethical investing strategies that can be tax-efficient.

Remote Work and Digital Collaboration Tools

The shift towards remote work has opened up new sectors for investment, with implications for tax optimization strategies.

Implications for SIPs and Direct Equity

- Digital Infrastructure: Investing in companies that provide digital collaboration tools can offer growth potential. SIPs focused on tech funds can provide diversified exposure with tax benefits.

- Work-Life Balance: Companies promoting remote work may see increased productivity, offering stable returns. Direct equity investments in such companies can be strategically tax-optimized.

- Cultural Shifts: The evolution of workplace culture impacts investment choices, influencing both risk assessments and the tax planning of portfolios.

Conclusion

For tech professionals in 2026, the choice between SIPs and direct equity requires a nuanced understanding of market trends and tax implications. By leveraging advancements in AI, capitalizing on sustainability, and focusing on emerging sectors like healthcare and cybersecurity, investors can optimize their tax strategies. As the investment landscape evolves, staying informed and flexible will be key to maximizing after-tax returns and achieving financial goals.

Disclaimer: This post is for educational purposes only and does not constitute financial advice. Read our full disclaimer here.